What is QPI?

Quantitative Portfolio Intelligence (QPI) is our proprietary platform designed to develop quantitative models for evaluating stocks and trading strategies offered through U.S.-regulated copy-trading services — with access to over 5,200 strategies.

What QPI Enables

Creation of models applied to trading strategies and stocks

Construction and simulation of portfolios based on trained models

Development of automated, real-time portfolio strategies

Note:

The performance data shown is hypothetical and provided for informational purposes only. Results reflect simulated strategies with estimated slippage, commissions, and assumed fees (2% management / 20% performance).

All figures are denominated in U.S. dollars.

Past performance is not indicative of future results.

QPI Product Suite

The QPI platform powers three institutional-grade products.

Below, we highlight our flagship trading strategy, designed to deliver consistent, risk-adjusted returns across market cycles.

Strategy Overview

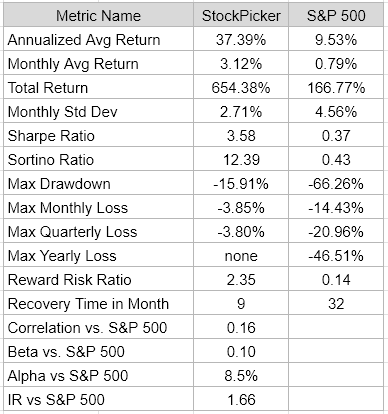

QPI StockPicker is a fully automated long/short equity strategy that applies a proprietary, rule-based model to score and trade stocks within the S&P 500.

By focusing on this liquid and transparent universe, the strategy enables:

Efficient execution

Robust validation

Scalable alpha generation

Positions are systematically rebalanced using refreshed quantitative metrics, with trade frequency optimized to capture short-term alpha while maintaining cost efficiency.

Portfolio Construction & Risk Management

Emphasis on diversification, disciplined position sizing, and layered risk controls

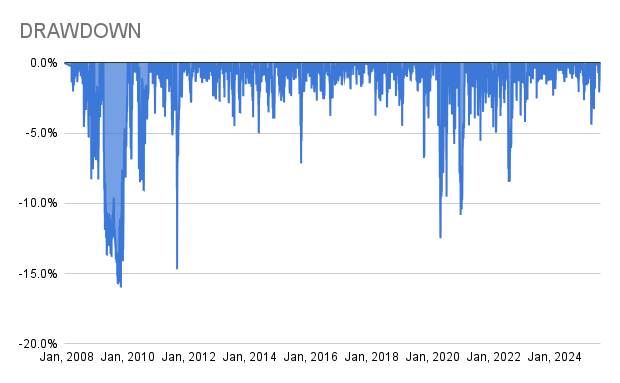

Includes stop-loss logic and capital-at-risk limits

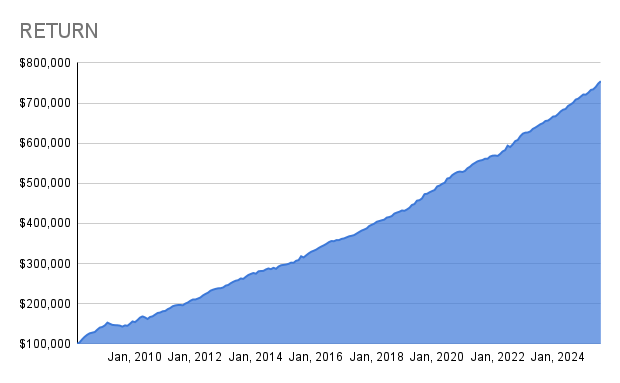

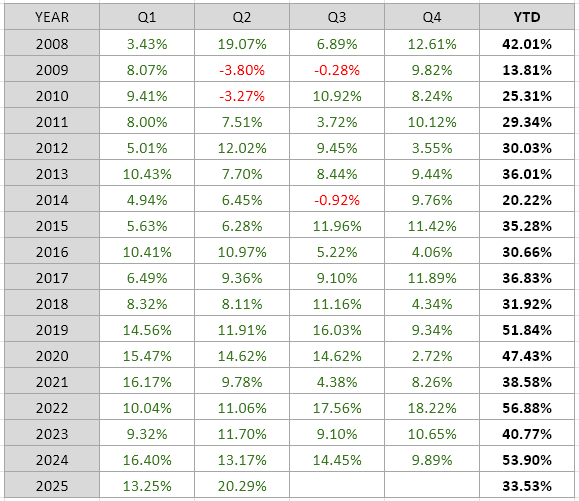

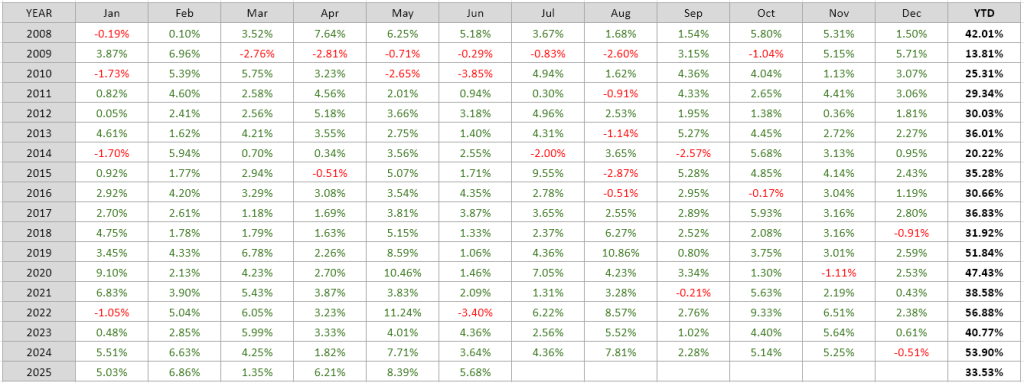

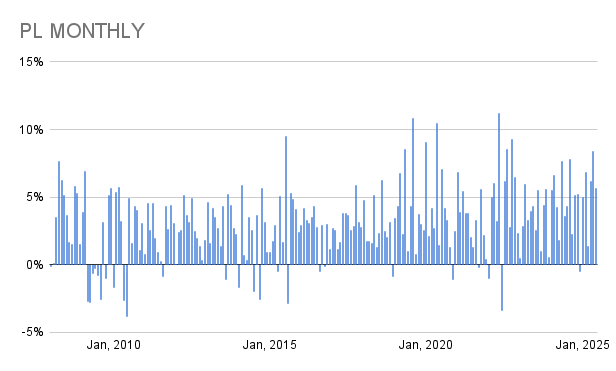

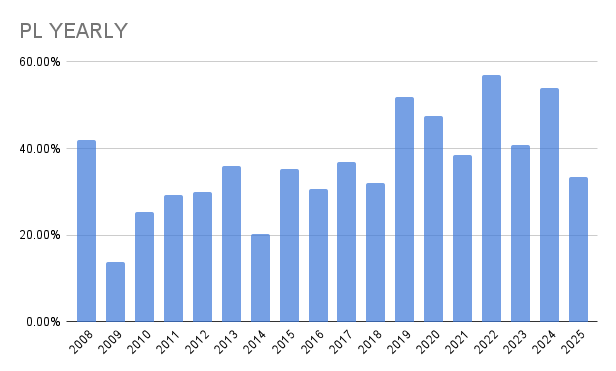

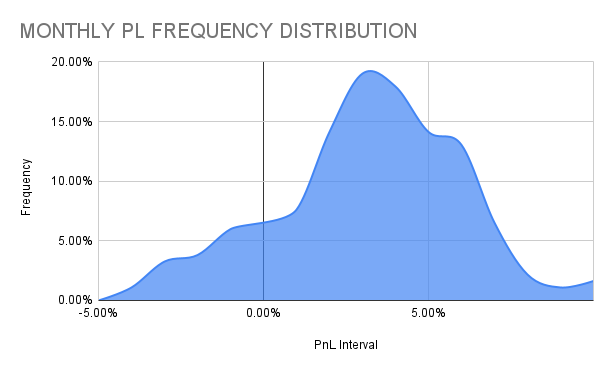

Validated through 17+ years of historical simulation and live capital deployment

Designed for low correlation to major equity benchmarks

Hedged structure supports performance across bull and bear markets

A valuable diversifier for both individual and institutional investors

Key Strategy Highlights

Strategy Type: Systematic Long/Short Equity

Investment Approach: Fully automated, data-driven model using proprietary multi-factor scoring for long and short positions

Rebalancing Frequency: Regular and systematic, based on updated quantitative scores to balance alpha capture and turnover

Holding Period: Varies by position; based on strength and consistency of model signals

Model Design: Rule-based, adaptive to market conditions, validated through 17 years of simulation and live capital

Risk Management: Daily reviews, strict position sizing, stop-loss thresholds, capital-at-risk controls

Target Returns: 35%+ average annualized return with drawdowns under 20% (historical simulation + live data)

Market Cycle Resilience: Designed for both bull and bear markets; proven strength in volatile conditions

Correlation Profile: Low correlation to broad equity indices; strong potential for portfolio diversification

Capital Allocation: Broad exposure to long and short positions, governed by proprietary sizing constraints

Portfolio Fit: Enhances risk-adjusted returns; helps reduce beta exposure in traditional equity portfolios

Investment Flexibility

Liquidity: No lock-up period — investors may enter or exit at any time

Disclosures

Disclaimer

This content is provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities or investment products. Any such offer or solicitation will be made solely through formal offering documents, which include important information regarding risks, fees, and expenses. This content is not intended for use or distribution in any jurisdiction where such use would violate applicable laws or regulations.

The strategy described herein is offered through a structure operated by a registered investment fund manager and exempt market dealer. Lisa Chen Trading Inc. (LCT) is not itself a registered dealer, portfolio manager, or investment fund manager. Investment-related communications are conducted by individuals duly registered with a regulated entity.

Offered pursuant to Regulation D, Rule 506(b/c), this opportunity is available only to qualified investors, including accredited investors, qualified purchasers, permitted clients, or other eligible individuals and entities as defined under applicable securities laws. It is not intended for retail investors unless allowed under specific exemptions.

Performance Disclosure

The performance information presented includes both hypothetical (backtested) and live trading results. Hypothetical performance is shown for illustrative purposes only, is based on assumptions that may not reflect actual conditions, and involves limitations. Actual results may differ materially. No assurance is provided that future performance will resemble the figures shown.

Performance metrics such as returns, volatility, Sharpe ratio, and correlation are derived from data believed to be reliable, but they have not been independently audited. Unless otherwise stated, performance figures are net of simulated management and performance fees and may change without notice. Past performance—actual or hypothetical—should not be relied upon when making investment decisions.

Risk Disclosure

Investing in hedge funds and alternative strategies involves substantial risk, including the risk of loss of principal. The strategy may employ leverage, short selling, and other advanced techniques that can increase exposure to market fluctuations and are not suitable for all investors. No guarantee can be made that the strategy will meet its objectives or avoid losses.

Forward-Looking Statements

This content may include “forward-looking statements” such as projections, forecasts, or estimates of future performance. These statements are based on assumptions, involve risks and uncertainties, and should not be viewed as guarantees of future results.

Confidentiality & Distribution

This material is confidential and intended solely for the individual or entity to whom it is delivered. It may not be reproduced, shared, or used for any other purpose without the express written consent of LCT or its affiliates.